Privacore VPC Asset Backed Credit Fund seeks high income potential through a diversified portfolio of asset-backed credit.

as of August 31, 2025

$10.04

net asset value per share

as of February 18, 2026

$10.01

net asset value per share

as of 1/7/2026

$10.00

net asset value per share

as of February 18, 2026

$10.00

net asset value per share

as of February 18, 2026

Privacore VPC Asset Backed Credit Fund is sub-advised by Victory Park Capital.

Privacore VPC Asset Backed Credit Fund (“AltsABF” or the “Fund”) aims to provide institutional-quality exposure to primarily private asset-backed credit, thoughtfully designed to meet the needs of private wealth investors. The Fund is sub-advised by Victory Park Capital (VPC), a dedicated private asset-backed credit manager established in 2007 that has focused on this space since 2010.

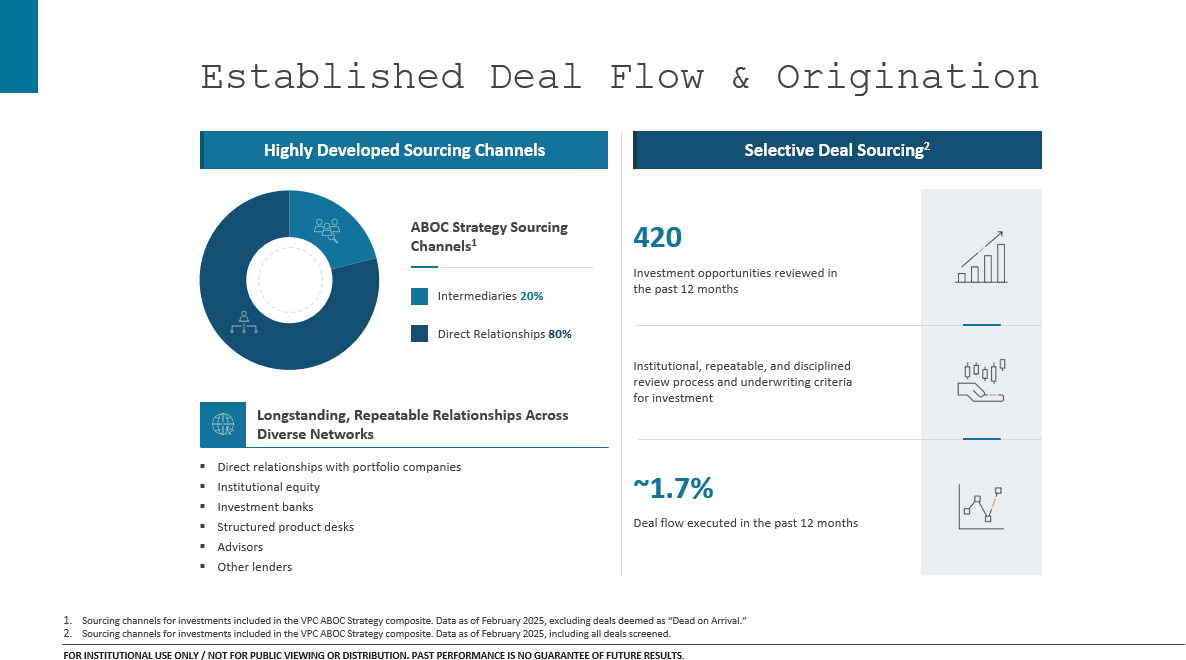

Privacore VPC Asset Backed Credit Fund seeks to achieve a high level of current income and, to a lesser extent, capital appreciation, through a diversified portfolio of credit instruments backed by physical, financial, or intellectual assets. With a strong emphasis on disciplined risk management, the Fund applies rigorous sourcing and underwriting to build a diversified portfolio spanning consumer credit, small business financing, real estate, legal credit, and physical assets.

Structured as a registered interval fund, it combines institutional portfolio management with investor-friendly features such as daily subscriptions, quarterly redemptions, 1099-DIV tax reporting, and no accreditation required. *

*Subject to investment minimums and applicable broker-dealer or platform eligibility requirements. Please refer to the Fund’s prospectus for full details.

Sub-advised by Victory Park Capital, a seasoned private credit manager with deep institutional experience.

¹Data as of December 31, 2025

Other funds in the market risk being overexposed to a single firm, single segment of the market, or could be forced into large, consensus opportunities.

Note: Bullets denote subsectors that are potential industries for investments. There are no assurances that the Fund will invest in the intended Sectors and Subsectors cited above, or that VPC has historically completed investments in the Sectors and Subsectors cited above.

Privacore Capital is an open-architecture provider, trusted partner, manager, and distributor for alternative investment products tailored to Private Wealth clients. The firm’s strong leadership team has over 30 years on average of investment experience. They are industry experts with proven track records of building dynamic alternatives-focused businesses and products. The leadership is supported by a growing team of seasoned professionals with extensive experience in alternatives, Private Wealth sales, and distribution.

Victory Park Capital Advisors, LLC (“VPC” or the “Firm”) is a global alternative asset manager that specializes in private asset-backed credit. The Firm was founded in 2007 and is headquartered in Chicago. VPC has specialized in asset-backed finance since 2010. In 2024, VPC became a majority-owned affiliate of Janus Henderson Group.

Important Disclosure Information:

Investors should consider the investment objectives, risks, charges and expenses of Privacore VPC Asset Backed Credit Fund (the “Fund”) carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call U.S. Bank at 888-982-2590 or download the file on this page. Read the prospectus carefully before you invest. Investing in the Fund involves risk including loss of principal.

The Fund is a non-diversified, closed-end investment company that is structured as an interval fund. The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s investment objectives will be achieved or that its investment program will be successful. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

The Fund is not a liquid investment. Limited liquidity is provided through quarterly repurchase offers. Each repurchase offer will be for no less than 5% nor more than 25% of the Fund’s Shares outstanding. The Fund should be viewed as a long-term investment and is only suitable for investors who can bear the risks associated with this limited liquidity. Investors should not expect to be able to sell or liquidate all desired Shares in the repurchase offer. Please see the Fund’s prospectus for “REPURCHASE OF SHARES”.

Distributions are not guaranteed and there is no assurance the Fund will achieve its investment objectives. The amount, frequency, and sources of any distributions are uncertain. Distributions may be paid from sources other than investment income and may include a return of capital, which could reduce the tax basis of shares and potentially increase the taxable gain upon their sale. To meet distribution or liquidity needs, the Fund may be required to sell assets at a loss, which could negatively impact net asset value.

Asset-backed credit may include loans, notes, receivables, and other credit instruments secured by financial, physical, or intellectual assets. These instruments are subject to credit and default risk, and they often lack centralized trading, which can limit transparency and make them difficult to value or sell. Realized sale prices may fall below recorded values, especially in stressed market conditions. Third-party originators may vary in their ability to assess creditworthiness, detect fraud, and pursue recoveries.

Private Credit refers to direct lending or debt financing outside of traditional banking, typically involving non-publicly traded companies, and comes with increased risk including limited liquidity, reliance on the borrower’s financial health, and less regulatory oversight compared to traditional bank lending.

Senior secured loans, including first and second lien positions, are backed by collateral and rank higher in the capital structure, but they are not immune to loss. Collateral may decline in value, be difficult to liquidate, or prove insufficient in distressed scenarios. Subordination to other creditors and deterioration in borrower financial condition can impair recovery, even when a loan is secured.

Legal, tax, and regulatory changes may materially impact the Fund’s investments. These changes may arise from U.S. or foreign agencies, regulators, or self-regulatory organizations, and may include shifts in enforcement or interpretation. In times of market stress, authorities may also take extraordinary actions that adversely affect the Fund.

Legal credit, or litigation finance, investments involve unique legal and recovery risks, including limited disclosure, uncertain timing of outcomes, and reliance on counterparties’ ability to pay. Outcomes depend heavily on legal professionals and external experts, and settlements may be delayed, rejected, or overturned despite prior agreements.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Funds classified as non-diversified can take larger positions in a smaller number of issuers than diversified funds, which could lead to greater volatility. The Fund has limited operating history upon which investors can evaluate potential performance. The Fund differs from open-end investment companies in that investors do not have the right to redeem their shares on a daily basis. Instead, repurchases of shares are subject to the approval of the Fund’s Board of Directors. The Fund is not a liquid investment. LIQUIDITY IN ANY GIVEN QUARTER IS NOT GUARANTEED. YOU SHOULD NOT INVEST IN THE FUND IF YOU NEED A LIQUID INVESTMENT.

Privacore Capital Advisors, LLC is the investment adviser of the Fund and Janus Henderson Distributors US LLC is the distributor. Victory Park Capital Advisors, LLC, a subsidiary of Janus Henderson, is the sub-adviser to the Fund. Privacore Capital is an affiliate of Janus Henderson US (Holdings) Inc.

Janus Henderson Group plc ©

AltsGrow semi-liquid strategy addresses structural challenges of traditional close-ended drawdown funds. The fund offers immediate capital deployment, with 100% of investors’ funds put to work on day one.

This deployment efficiency addresses investors and advisors’ concerns on typically sluggish capital deployment seen in traditional drawdown funds, prompting a shift towards more fluid investment approaches.

Important Disclosure Information:

Investors should consider the investment objectives, risks, charges and expenses of Privacore PCAAM Alternative Growth Fund (the “Fund”) carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call UMB Fund Services at (855) 685-3093 or download the file on this page. Read the prospectus carefully before you invest. Investing in the Fund involves risk including loss of principal.

The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s investment objectives will be achieved or that its investment program will be successful. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

The Fund is not a liquid investment. You should generally not expect to be able to sell your Shares (other than through the limited repurchase process), regardless of how we perform. Although the Fund is required to implement and has implemented a Share repurchase program, only a limited number of Shares will be eligible for repurchase by the Fund. As a result, an investor may not be able to sell or otherwise liquidate his or her Shares. Please see the Fund’s prospectus for “REPURCHASE OF SHARES”.

Investors should be aware that investments in private equity are speculative and often include a high degree of risk. Investors could lose the entire amount of their investment or recover only a small portion of their investment if the fund suffers substantial losses. Shares are appropriate only for those investors who can tolerate a high degree of risk and do not require a liquid investment and for whom an investment in the Fund does not constitute a complete investment program.

Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. All investors in the Fund must be “Accredited Investors”, as defined in Regulation D under the Securities Act of 1933. The Fund is a non-diversified, closed- end investment company designed for long-term investors and not as a trading vehicle. Funds classified as non-diversified can take larger positions in a smaller number of issuers than diversified funds, which could lead to greater volatility. The Fund has limited operating history upon which investors can evaluate potential performance. The Fund differs from open-end investment companies in that investors do not have the right to redeem their shares on a daily basis. Instead, repurchases of shares are subject to the approval of the Fund’s Board of Directors. The Fund is not a liquid investment. LIQUIDITY IN ANY GIVEN QUARTER IS NOT GUARANTEED. YOU SHOULD NOT INVEST IN THE FUND IF YOU NEED A LIQUID INVESTMENT.

Privacore Capital Advisors, LLC is the investment adviser and Partners Capital Investment Group, LLP is the sub-adviser to the Fund. Janus Henderson Distributors US LLC is the distributor. Privacore Capital is an affiliate of Janus Henderson US (Holdings) Inc.

Thank you for your interest in Privacore Capital.

We look forward to hearing from you.

To download the AltsGrow Fund Presentation, please complete the following information.

This site and the materials herein are directed only to certain types of investors and to persons in jurisdictions where Privacore VPC Asset Backed Credit Fund (AltsABF) is authorized for distribution.

An investor should consider the investment objectives, risks, charges, and expenses of AltsABF carefully before investing. Complete information about investing in shares of AltsABF is available in the prospectus. An investment in AltsABF involves risks.

I acknowledge that (i) I have received the Prospectus and (ii) either (a) I am a resident of a jurisdiction where AltsABF is authorized for distribution or (b) I have otherwise received guidance from my broker-dealer/registered investment advisor to access the contents of this website.